Two Things Every Business Should Do to Lower Their Credit Card Processing Costs

Prior to my current job, I worked in Sales and then Sales Strategy at Square. In those roles, I spoke to small business owners every day who wanted to focus exclusively on running their amazing businesses.

Credit card processing was a necessary evil - a topic that they wanted to set up and then forget about. Unfortunately, that approach can be very costly. If not set up correctly, credit card processing can be a huge drain on a business and take away much-needed profits.

I spoke to business owners of all kinds who were not taking some very simple steps which could've saved them thousands of dollars a year in credit card fees. I wanted to share some of those steps here in the hopes that it might help businesses that aren't quite sure where to start when it comes to credit cards.

While most of my experience in the space comes from my time at Square, this is definitely not an advertisement for their services. The information below applies to all credit card processors. If you own a small business, I hope it can change the way you look at how to optimize your payment flow.

Tip No. 1: Reduce "Card Not Present" transactions - especially Keyed In payments

Credit card processors generally categorize transactions into two different groups: Card Present and Card Not Present.

As the name suggests, Card Present describes an in-person transaction where the customer is presenting their physical card to the merchant.

Card Not Present is all "remote" transactions - including e-commerce and invoices, or any other transaction where a customer's card is not physically present. Card Not Present also has a subcategory known as Keyed In, which refers to card-on-file transactions, or any other payment where the customer's credit card number is manually entered in by a staff member.

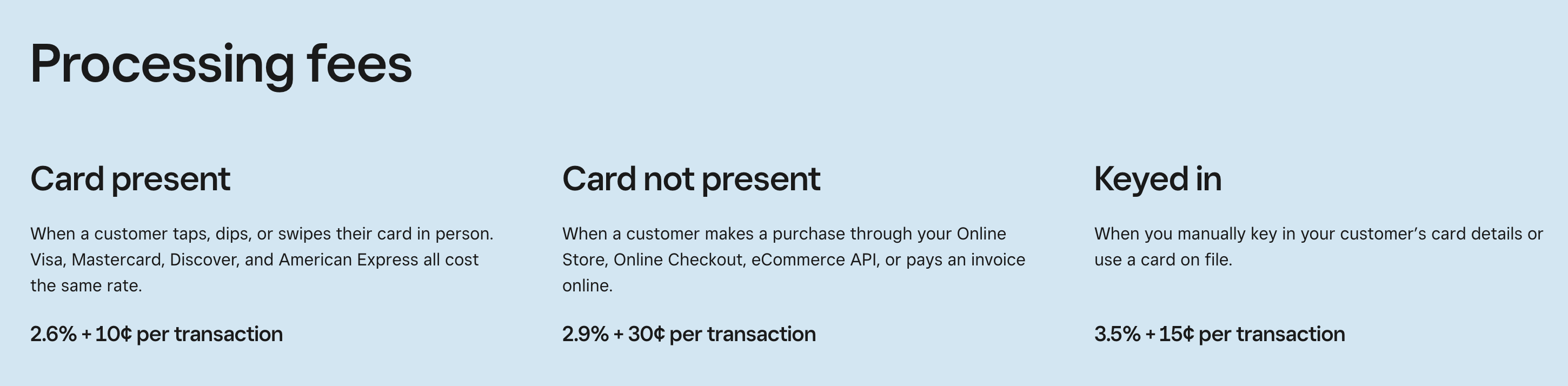

The different types of transactions come with significantly different rates, as you can see from Square's US pricing (as an example):

There's three key takeaways here:

- Card Present is the cheapest processing option.

- Card Not Present is slightly more expensive than Card Present.

- "Keyed In" transactions are by far the most expensive type of transaction.

All processors always charge the least for Card Present transactions - this isn't unique to Square. There is simply a lower risk of fraudulent payments when the customer is physically present with their credit card. So, if all else is equal, merchants should prefer to take payments in person over any other option.

In addition, notice how similar payment methods have significantly different costs. Having a customer pay an invoice online vs. charging their card on file doesn't seem that different. But in reality, for a $1,500 transaction, that's a $9 difference. Trust me when I say that it adds up over time.

Many small business owners I spoke to were aware of this dynamic and knew they should never be keying in payments. But when we looked at their statements together, we often found that reality was much different than they imagined.

One example I came across in my time at Square was with a towing company in Texas. They were using a processor that supplied them with mobile credit card readers for their drivers to use in the field. That seemed great, because their drivers can collect a Card Present transaction for a tow right on the spot.

Unfortunately, the readers they had weren't very reliable. They broke down so often that some drivers had given up using them altogether. Instead, the drivers would manually record the customer's card number, either on paper or by calling the dispatch office. Then, they would charge the customer later by keying in the number.

This simple practice was costing the business thousands of dollars per year. The difference between 3.5% and 2.6% doesn't sound like much - on a $150 tow, it's $1.35. But for a towing company that did about 3,000 tows per year, that's $4,050 down the drain annually for no good reason.

The solution here was simple - the drivers needed credit card readers that worked, and in the rare case they didn't, they needed an online portal for customers to pay so that could avoid a key in.

There are tons of other examples of how many different types of businesses could save a lot of money by tweaking their operations to reduce keyed in transactions and moving towards the cheapest payment options:

- Charging customers for takeout food in person instead of taking their card details over the phone.

- Having backup credit card readers on hand, even from a different processor, so that you can still take card payments even if your reader breaks.

- Pushing customers to an online booking portal to make a new transaction every time instead of using a card on file.

- Use pre-authorizations on customers' credit cards for the value of equipment being rented, instead of recording the customer's credit card number and charging it later if the equipment is lost or damaged.

This ultimately boils down to setting up the right processes and educating staff. If you build your business flow around maximizing the cheapest type of transactions, then you'll make things much easier on yourself. And when things break down (like in the towing company example), your staff will understand that keying a transaction is a true last resort, instead of an immediate backup.

Tip No. 2: Find creative ways to increase average transaction size

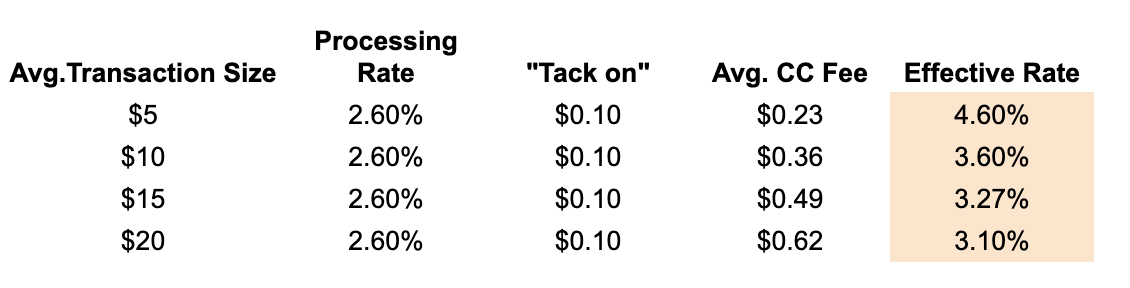

Taking another look at Square's pricing in the screenshot above, you'll notice that all three rates have a "tack-on", or a fixed price between 10 and 30 cents that is attached to each transaction no matter the size. This practice is quite common across the credit card processing industry.

The effect of these tack-ons is that merchants with small transaction sizes are really penalized. To understand why, we need to look at the effective rate merchants pay in various scenarios. The effective rate is the total processing fee divided by the transaction size:

So, a merchant with a $5 average transaction size will pay a credit card processing rate of 4.6%, while a merchant with a $20 transaction size will pay a rate of 3.1%. For a business that processes $1M per year, that's a $15,000 difference.

Again, many business owners are already aware of this dynamic, but they find it difficult to change their average transaction size due to the nature of their business. For example, if you're running a coffee shop, you might think it's going to be next to impossible to get higher than a $5-$10 average transaction, because no one will pay more than that for a coffee and a pastry.

But the math above shows that if business owners can get creative, they can save big money. One clever strategy I saw in Brooklyn was a coffee shop selling a larger tin of ground coffee for over $150. I was shocked by the price at first, but then I realized that the tin came with 10 free refills, despite being the cost of 8 individual tins. So, I was getting a great deal, and since I loved the coffee shop, I didn't hesitate to spring for the larger purchase.

This model of selling in bulk for a slight discount is great for the merchant in a ton of ways. For instance:

- They have improved cash flows because they get more money upfront

- Customers are more loyal because they know they have "credit" to use and feel like they're getting a great deal

- Any unused portion of the credit is pure profit for the business

But most of all, they jack up their average transaction size and lower their credit card costs. At the end of the year, this practice makes an enormous difference and adds profits to the bottom line.

The credit card processing industry is incredibly complicated, and there's much more that businesses can do to lower their rates - which will be the subject of future posts. But I believe that by taking a few simple steps, many businesses could save themselves a lot of money without much effort.

What has your experience been with credit card processing? Feel free to reach out via the "Contact" page and I would be happy to chat about ways you might be able to keep more of your revenue and give less to credit card companies.

David McIntyre Newsletter

Join the newsletter to receive the latest updates in your inbox.